Solera is your resource for independent, unbiased education, comparison and selection in California.

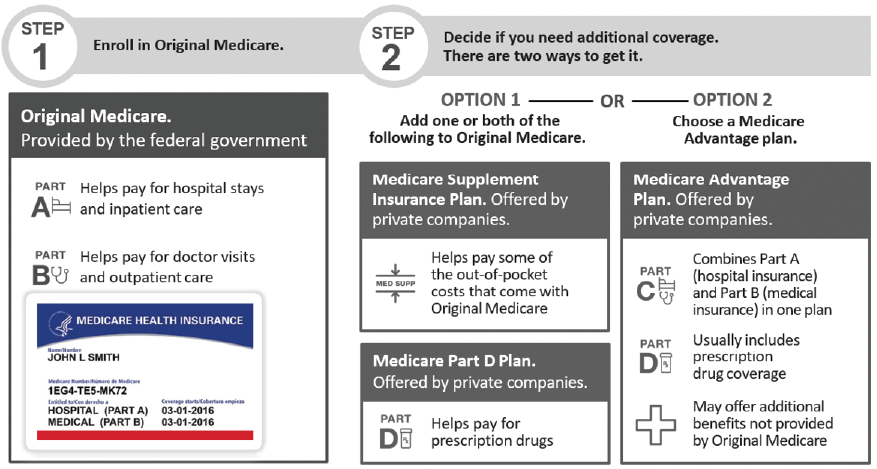

You have important decisions to make when you become eligible for Medicare. Yet, Medicare is a confusing subject for most people. We will help you understand traditional Medicare and explore options to ensure you feel confident about choosing coverage based on your needs — both when you first enroll and every year after that.