Protect Income

Solera offers plans designed to protect if you become too sick or injured to work, your benefits will kick in and cover you.

The goal of our insurance services is to help protect what matters to our clients; to help them make informed and wise decisions about estate preservation, succession planning, estate tax minimization, and asset protection.

You’ve worked hard to get where you are. The ability to work in your occupation or specialty is valuable. Disability insurance offers the peace of mind that your income and business is protected.

Learn moreLorem ipsum dolor sit amet, consectetur adipiscing elit. Integer in leo ligula. Nunc pulvinar erat nec facilisis pharetra. Sed ut lorem sed metus interdum sagittis. Curabitur sollicitudin justo a risus maximus, commodo consectetur urna congue. Aenean sollicitudin lacus ac lorem tincidunt interdum

Learn moreLorem ipsum dolor sit amet, consectetur adipiscing elit. Integer in leo ligula. Nunc pulvinar erat nec facilisis pharetra. Sed ut lorem sed metus interdum sagittis. Curabitur sollicitudin justo a risus maximus, commodo consectetur urna congue. Aenean sollicitudin lacus ac lorem tincidunt interdum

Learn moreLorem ipsum dolor sit amet, consectetur adipiscing elit. Integer in leo ligula. Nunc pulvinar erat nec facilisis pharetra. Sed ut lorem sed metus interdum sagittis. Curabitur sollicitudin justo a risus maximus, commodo consectetur urna congue. Aenean sollicitudin lacus ac lorem tincidunt interdum

Learn moreLorem ipsum dolor sit amet, consectetur adipiscing elit. Integer in leo ligula. Nunc pulvinar erat nec facilisis pharetra. Sed ut lorem sed metus interdum sagittis. Curabitur sollicitudin justo a risus maximus, commodo consectetur urna congue. Aenean sollicitudin lacus ac lorem tincidunt interdum

Learn moreLorem ipsum dolor sit amet, consectetur adipiscing elit. Integer in leo ligula. Nunc pulvinar erat nec facilisis pharetra. Sed ut lorem sed metus interdum sagittis. Curabitur sollicitudin justo a risus maximus, commodo consectetur urna congue. Aenean sollicitudin lacus ac lorem tincidunt interdum

Learn moreSolera offers plans designed to protect if you become too sick or injured to work, your benefits will kick in and cover you.

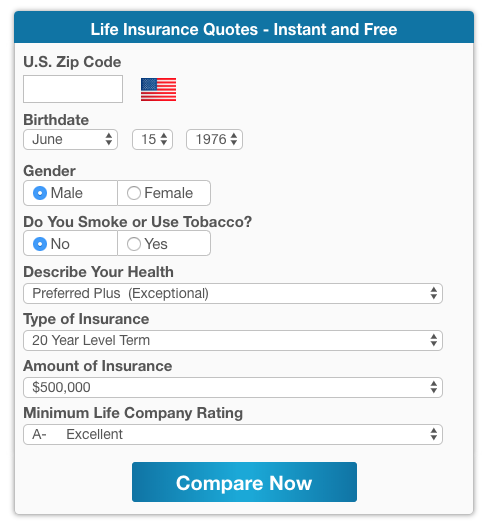

Compare options from top-rated insurance companies. Solera offers solid plans to shelter your family from unexpected future events.

With Solera, you can rest, knowing you’ve chosen the deepest discounts and strongest coverage available.

What would happen to your business if you were unable to work for an extended period of time due to an injury or illness? How would your rent, payroll and other expenses be paid if you are unable to produce? Disability insurance protects your income, but what protects your business?

Solera offers solutions for businesses as well, such as business overhead expense (“BOE”) disability policies. These cover the ongoing operating expenses and ensures that you do not have to use personal assets to pay for business expenses if you become disabled, keeping your business afloat so that you can recover.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed suscipit non dolor fringilla dictum. Fusce leo nibh, laoreet vitae tempor ac, porta eget metus. Donec egestas felis erat, et tincidunt dui eleifend non. Ut viverra feugiat massa. Proin dictum dui ex, et gravida quam lobortis ac. Vivamus dapibus risus a eros condimentum, a consequat arcu egestas. Quisque eget nisi est. Sed dignissim posuere molestie. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Mauris hendrerit sem maximus, viverra diam non, porta velit. Pellentesque habitant morbi tristique senectus et netus et malesuada fames ac turpis egestas. Pellentesque feugiat felis eros, eget pretium velit tempus vitae. Vestibulum facilisis condimentum diam non tempus. Vivamus sagittis, arcu at vulputate pharetra, nisi tellus imperdiet diam, in mollis ipsum lorem vitae nunc. Vivamus convallis porttitor dui et posuere.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed suscipit non dolor fringilla dictum. Fusce leo nibh, laoreet vitae tempor ac, porta eget metus. Donec egestas felis erat, et tincidunt dui eleifend non. Ut viverra feugiat massa. Proin dictum dui ex, et gravida quam lobortis ac. Vivamus dapibus risus a eros condimentum, a consequat arcu egestas. Quisque eget nisi est. Sed dignissim posuere molestie. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Mauris hendrerit sem maximus, viverra diam non, porta velit. Pellentesque habitant morbi tristique senectus et netus et malesuada fames ac turpis egestas. Pellentesque feugiat felis eros, eget pretium velit tempus vitae. Vestibulum facilisis condimentum diam non tempus. Vivamus sagittis, arcu at vulputate pharetra, nisi tellus imperdiet diam, in mollis ipsum lorem vitae nunc. Vivamus convallis porttitor dui et posuere.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed suscipit non dolor fringilla dictum. Fusce leo nibh, laoreet vitae tempor ac, porta eget metus. Donec egestas felis erat, et tincidunt dui eleifend non. Ut viverra feugiat massa. Proin dictum dui ex, et gravida quam lobortis ac. Vivamus dapibus risus a eros condimentum, a consequat arcu egestas. Quisque eget nisi est. Sed dignissim posuere molestie. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Mauris hendrerit sem maximus, viverra diam non, porta velit. Pellentesque habitant morbi tristique senectus et netus et malesuada fames ac turpis egestas. Pellentesque feugiat felis eros, eget pretium velit tempus vitae. Vestibulum facilisis condimentum diam non tempus. Vivamus sagittis, arcu at vulputate pharetra, nisi tellus imperdiet diam, in mollis ipsum lorem vitae nunc. Vivamus convallis porttitor dui et posuere.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed suscipit non dolor fringilla dictum. Fusce leo nibh, laoreet vitae tempor ac, porta eget metus. Donec egestas felis erat, et tincidunt dui eleifend non. Ut viverra feugiat massa. Proin dictum dui ex, et gravida quam lobortis ac. Vivamus dapibus risus a eros condimentum, a consequat arcu egestas. Quisque eget nisi est. Sed dignissim posuere molestie. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Mauris hendrerit sem maximus, viverra diam non, porta velit. Pellentesque habitant morbi tristique senectus et netus et malesuada fames ac turpis egestas. Pellentesque feugiat felis eros, eget pretium velit tempus vitae. Vestibulum facilisis condimentum diam non tempus. Vivamus sagittis, arcu at vulputate pharetra, nisi tellus imperdiet diam, in mollis ipsum lorem vitae nunc. Vivamus convallis porttitor dui et posuere.